How Accurate Are Survey Forecasts on the Market

Abstract

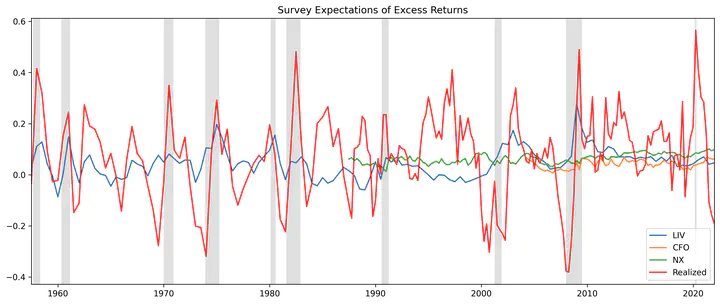

We provide a novel performance analysis of three widely used survey forecasts along with naive and analyst predictions. We find that none of the popular survey forecasts can predict the stock market out-of-sample, and the surveys are not very informative about investors' attitudes toward risk. Our study raises important questions on how to safeguard the use of survey forecasts and how to properly interpret the results from the large literature that relies on them. On the other hand, we show that a naive Bayesian learning and forecasts using analysts' expectations can outperform the surveys, suggesting that the study on these can potentially be more important and deserve more attention than the study of survey forecasts.