ETFs, Anomalies and Market Efficiency

Abstract

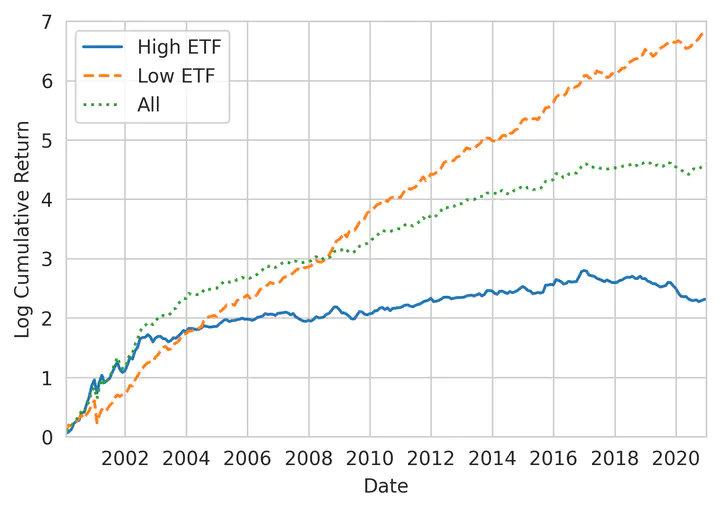

We investigate the effect of ETF ownership on stock market anomalies and market efficiency. We discover that low ETF ownership stocks exhibit higher returns, greater Sharpe ratios, and highly significant alphas compared to high ETF ownership stocks. We show that high ETF ownership stocks demonstrate more pronounced information flows than low ETF ownership stocks, leading to reduced mispricing and increased informational efficiency. We document similar results when we match the two groups based on size, volume, book-to-market, and momentum. Our results remain robust to different matching methods and a wide array of controls in Fama-MacBeth regressions. Using Russell index reconstitution as a natural experiment, we uncover causal evidence that ETF ownership attenuates anomaly returns.